Japan is Moving Toward a Cashless Society

A notoriously cash-reliant society, by 2021, cashless payments in Japan claimed 32.5% of all purchase transactions.

With e-money and QR code options increasingly widespread, the trend is also changing consumer behavior.

A “Cashless Vision” for Japan

In 2018, Japan’s Ministry of Economy, Trade, and Industry (METI) formulated a Cashless Vision to move Japan toward a cashless society. It aims to increase cashless purchases to 40% by 2025 and to 80% thereafter, with the goal of addressing labor shortages, regional revival, and productivity.

As part of this initiative, the Japanese government plans to adopt a system for companies to pay employees’ salaries digitally—without going through bank accounts—by spring 2023.

The ability for businesses to pay salaries through smartphone payment apps intends to lessen the difficulties faced by foreign workers in Japan, who frequently have trouble opening bank accounts. Additionally, it lowers the administrative costs related to payroll payments.

In addition, a digital-first Japan will also assist in the expansion of the financial services market, deregulation, and boosting growth.

To assist this effort across industries, the "Cashless Promotion Council," which unites the government, educational institutions, research institutes, and commercial businesses, was also founded in 2018.

According to the group, cashless payments in Japan increased from 13.2% in 2010 to 32.5% in 2021. This is sluggish when compared to other Asian countries, such as South Korea (93.6%), China (83.3%), or Singapore (60.4%), all of which had far higher percentages in 2020.

The most popular cashless payment methods in Japan

1. Credit card

Among all cashless payment methods, 77% of all purchases are made with credit cards. In 2020, purchases made via credit cards totaled a record high of 74.4 trillion yen.

2. Debit card

Debit card payments come in second, with more than 2.2 trillion yen spent in 2020, including via J-Debit and Visa cards.

3. E-money (any digital transaction processing service).

As financial systems continue to shift toward digital, offline transactions are quickly becoming obsolete.

E-money fulfills most types of transaction requirements, including prepaid payments—the user tops up a mobile app or card prior to the transaction—and postpaid payments, when the user is charged at a later time.

Commuter cards and QR/barcode payments

58% of commuters in Japan use IC (Integrated Circuit) cards such as Suica, Passmo, and ICOCA to travel on buses, trains, and the metro. And for decades, most of these cards have had the capability to be used as e-money. Suica introduced its “Shopping Service” back in March 2004.

Recently, however, there has been a surge in the number of people using commuter cards to buy goods from shops and convenience stores nationwide.

Regarding QR and barcode systems like PayPay, over 4.2 trillion yen in payments were transacted in 2020. And with more than half of Japanese adults already using e-money, adoption of this payment method is expected to rise much further.

How payment options effect purchase potential

In a survey on e-commerce payment methods comparing 2018 with 2020, people were surveyed about the payment methods they most frequently use at online retailers. It found that use of credit cards had declined while e-money payment methods had increased.

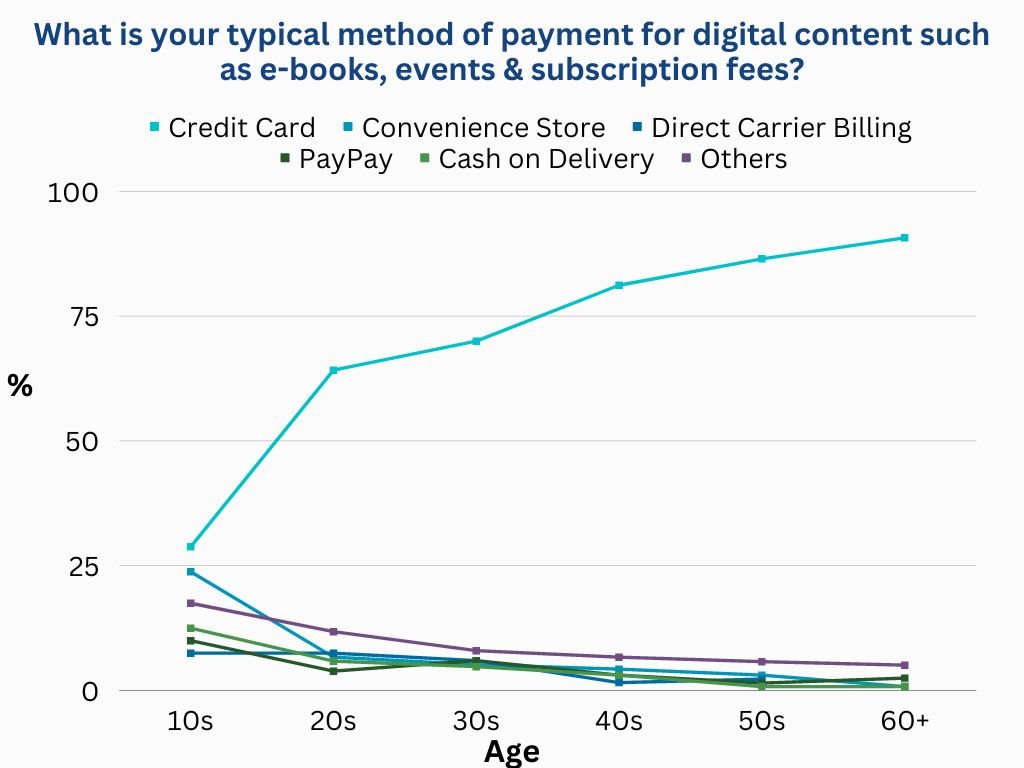

Credit cards are the favored mode of payment across all demographics, regardless of purchase size or gender.

However, fewer than 40% of teenagers used credit cards, preferring convenience store purchases, direct carrier billing (which allows users to purchase digital content and items via their mobile phone carrier using a code), PayPay (online) payments, or cash on delivery (45%).

Alternatives to credit cards such as PayPay, cash on delivery, and direct carrier billing were used by over 20% of men in their twenties and thirties.

These results show how important it is for e-commerce businesses to offer customers a variety of payment options.

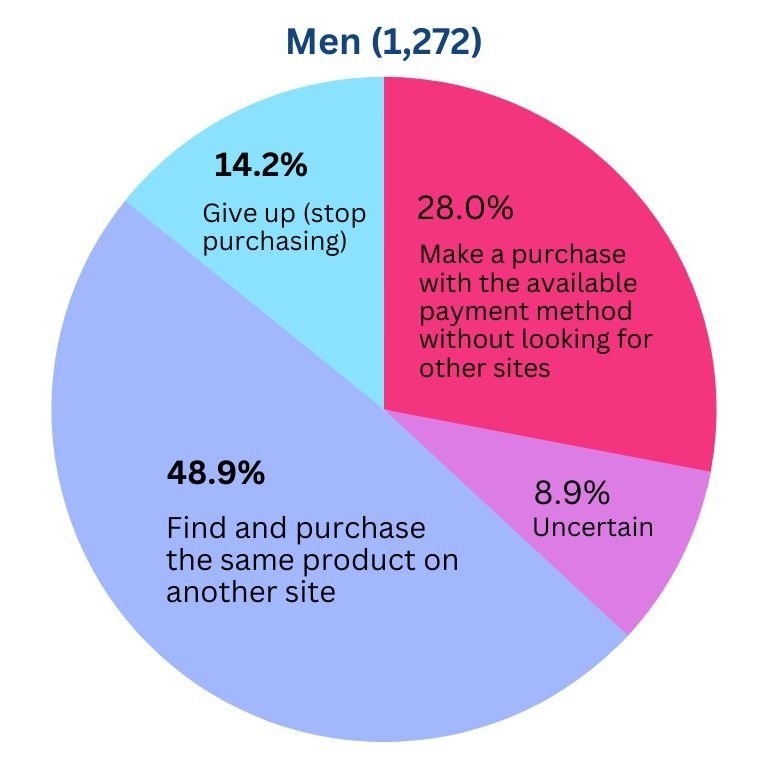

Survey respondents were also asked about their fallback plan if they couldn't use their preferred online payment method. 60% of both males and females said that if they were looking for physical goods, they wouldn't buy anything from the site at all. And 70% of male and 60% of female respondents said the same about buying digital content.

When shopping online, what action would you take if you could not use your preferred payment method?

So, as these results suggest, payment options (or lack of them) can make or break the completion of a sale. Therefore, businesses must prioritize understanding not only what consumers want but also how they intend to make a purchase.

The recent surge in demand for cashless payment options in Japan has been prompted by a strong ambition for a cashless existence and the consequences of the pandemic on people's lives.

Whether Japan can become even as much as 80% digital within the decade is uncertain, but current insights are very positive.

Based in Tokyo, An-yal is the leading independent advertising agency for global lifestyle brands in Japan and worldwide. Contact us to get ahead with your integrated marketing and creative needs.