Current State of Japan’s Restaurant Industry & Changing Lifestyles

It’s not uncommon for people to eat out almost every day in Japan. Many restaurants serve high-quality food at very low prices and the variety is limitless, from Japanese fast-food to Italian cuisine arranged to suit the local pallet. As in most other places though, Covid-19 forced major changes to the daily routines of Japanese people.

After this year's Golden Week (a long holiday season from the end of April to early May), significant limitations on domestic and international travel were lifted for the first time in two years. And so this seemed like a hopeful restart to ‘normal’ life.

However, then came a sudden spike in positive infections described as the “7th wave’” And despite the related symptoms being relatively mild, this brought more restrictive actions that hit squarely and heavily upon Japan’s restaurant industry.

2022 sees growth in all sectors

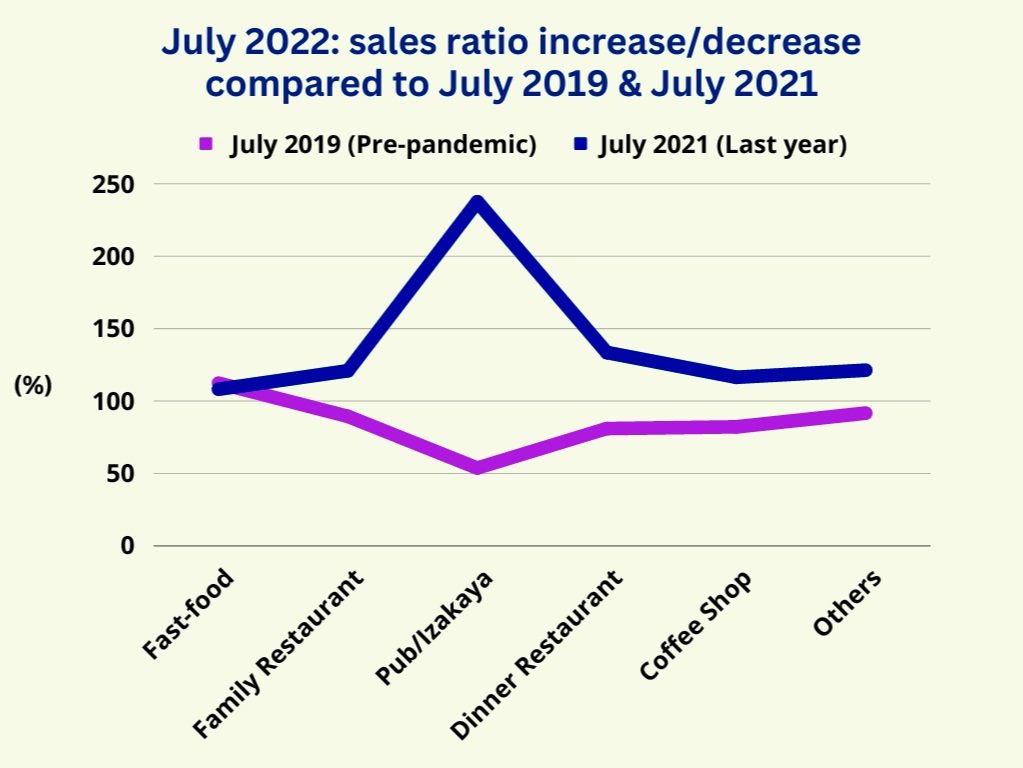

Here, we take a quick look at how the pandemic has impacted people's lifestyles and economic activities as well as the restaurant industry. Our insights are based on data released by the Japan Foodservice Association and compare data from the month of July 2022 with July 2021 and pre-pandemic July 2019.

Last year, the vast majority of restaurant businesses were forced to limit operations due to the pandemic; however, July 2022 saw year-on-year sales growth in all sectors, including fast food, family restaurants, pubs and izakayas, and dinner restaurants (establishments that require a high average spend per customer and high added value in product content, service, and atmosphere).

In particular, the highest sales rate increase was for pubs and izakayas, at 237.6% compared to last year. This sector had been among the most negatively affected due to the near-universal ban on serving alcohol in public places during most of 2021.

The second biggest sales rate increase is dinner restaurants at 133.2%, followed by yakiniku (self-barbecue meat) restaurants at 131.7%.

Fast-food beats pre-pandemic results

Despite this year’s positive sales results, it is clear that the restaurant industry is still in the midst of recovery. When comparing this July’s results to pre-pandemic 2019, almost all sectors are low (sales at pubs and izakayas, only 58%, and dinner restaurants, 80.6%).

Interestingly, though, the only sector that has surpassed 2019 in sales is fast food, which saw a 12.1% rise. Reasons can in part be attributed to many fast-food restaurants’ newly offering take-out and delivery services and also being some of the very few options while many other restaurants were closed at the time.

Changing lifestyles and drinking more at home

As people’s lifestyles have quickly changed, so has the way that they drink. By the end of 2020, drinking at home had increased by 13.6% compared to the previous year. And spending more time at home alongside increasing work-from-home lifestyles has since created new demands.

Last year, one of Japan’s largest beer producers, Kirin, began offering a monthly ‘beer server rental’ and home delivery service where people can order a minimum of 4 liters of various Kirin beers to enjoy in the home at fairly reasonable prices.

However, with izakaya chain restaurants like Teke-Teke and Ikkyu back to pre-pandemic service levels and selling draft beers at under ¥200 a glass, some of this demand may likely wain.

Compared to the pre-pandemic period, it’s clear Japan’s restaurant industry is far from recovery, and it will be interesting to see how people's eating-out habits will change in the future, especially after becoming accustomed to home delivery, takeout, or preparing food at home.

From October on, large events and stadium concerts with international artists are scheduled. Also, it has now been confirmed that more restrictions will be lifted and Japan’s border will be open to more tourists and independent tourism. A hopeful restart Of course, this is all based on the assumption that the corona situation continues to stay calm.

Based in Tokyo, An-yal is the leading independent advertising agency for global lifestyle brands in Japan and worldwide. Contact us to get ahead with your integrated marketing and creative needs.